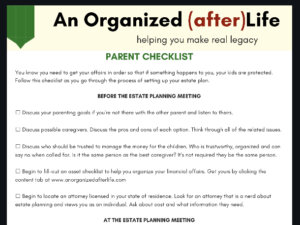

27 Jan Estate Planning Checklist for Parents

You know enough to know that parents need an estate plan. But how do you plan to protect your kids if something happens to them? What does that look like? Where do you even begin? What kind of estate planning do parents need to protect their kids? It might be complicated, but my estate planning checklist for parents can make it manageable.

The legal to-do list you leave behind, if you die when people depend on you, is complicated (read more about that here). When you think about the legal stuff people would have to navigate, the issues can be overwhelming. How should your assets transfer to benefit your kids? Who would raise them? How can someone get them to the doctor or deal with the school until all the legal stuff gets worked out?

If that all seems daunting to you, imagine what it would be like for people who would have to figure all of that out. It would be a mess! Unless you’ve put a plan in place that makes that legal to-do list manageable.

So how do you even begin getting a good… a thorough… estate plan in place when you’re a parent? Your estate plan will be complicated, but getting it done right is doable. I’ve created a downloadable checklist to help walk you through the things you need to think about, the people you need to talk to, and the questions to address. A parents’ estate plan might be complicated, but this checklist can make it manageable.

Now. Let’s walk through each step.

BEFORE THE ESTATE PLANNING MEETING

Whether you’re married to the other parent or not, sit down with them to talk about what your long term parenting goals are. What do you want for your children? What skills and characteristics do you want them to have when they’re adults? What things would you like them to be able to do, but are totally negotiable, things like education and home ownership. Talk about your parenting goals.

Discuss who you’d want to raise your kids if you’re not there to do it. Talk about the pros and cons of each option and think through all of the related issues. Consider things like living arrangements, age, and the possibility of couples divorcing. Your sister-in-law might be the best choice, or she might not be if she’s no longer married to your brother.

Also think through and talk about who should be trusted to manage the money for your children. That might be the same person you want to raise them, but it doesn’t have to be. Having a bit of distance between the person managing the money and the person raising the kids can make things easier for everyone. Think of someone who is trustworthy, organized and can say no when called for.

The first step of any estate plan is to get a handle on what you own. Begin to fill out an asset checklist to help you organize that financial information. List what you own and how it’s owned. Get your asset checklist by clicking the content tab.

Locate an attorney licensed in your state of residence. Look for an attorney who is a nerd about estate planning. How can you tell? If you talk to them or you look at their website, are they educating you. You’re really looking for a teacher who can show you the best way to accomplish the goals you have, or should have, for that legal to-do list you’ll leave.

That goes into another point. An attorney looking to educate you is more likely to view you as an individual with specific needs. That kind of lawyer will be obsessed with getting you the right tools, not just filling your name in a list of forms. Ask about cost and what information they need.

AT THE ESTATE PLANNING MEETING

Ask the attorney about how you can efficiently transfer assets between spouses. For most couples, this will mean using joint ownership of assets to set an automatic transfer when one spouse dies. Ask them to review the ownership of each major asset to determine what would be involved in transferring it. This is particularly important for real estate. Ask the attorney to review deeds to verify that your real estate transfers according to plan.

Talk through your choices for guardians, trustees, personal representatives and other roles with the attorney. Get their opinion on the reasons for your choices and if the legal process of appointing someone has factors you should consider that you haven’t thought about.

Ask for recommendations on how your assets should be held for your kids. For many people, trust provisions in your will that come into play if your kids are under a certain age will be the best fit. Ask how to properly list minor children or a trust for their benefit on insurance policies and beneficiary designations. Tax deferred retirement accounts, in particular, should have very specific wording to avoid the worst tax treatment.

Ask whether your state allows you to name a guardian to act immediately for your kids and until a court can put the long term guardian in place.

AFTER THE ESTATE PLANNING MEETING

Meet with your insurance agent, financial adviser, and retirement administrator to update beneficiary designations. Verify ownership and designations of bank accounts, cars, real estate are appropriate. Think through how these assets should transfer to a spouse and to your kids.

Talk to the guardians, trustees, personal representatives and anyone else you’ve nominated in your documents.

THERE YOU HAVE IT

You know you need go get your affairs in order so your kids are protected if something happens to you. That means you’ll have a complicated legal to-do list. But making that to-do list manageable is possible. Download the checklist and mark off each step as you go through the process of setting up your estate plan.

Pingback:Heath Ledger Estate and Updating Your Plan When You Have Kids

Posted at 17:47h, 26 December[…] where I talk more about what to think about when you’re doing your estate […]